Company incorporation in the Philippines starts with the submission of documents to the Securities and Exchange Commission (SEC), the government agency mandated to supervise the corporate sector in the country. It is compulsory for new enterprises to register with SEC first prior to other government agencies because the Certificate of Incorporation that SEC will issue for your business is a requisite of the certificates and permits that you need to secure when registering with other agencies.

You are required to transact with SEC for the company incorporation process. For the business registration process, you will be required to transact with five (5) or more government agencies – the specific number of which varies depending on the nature of your business and the need for additional licenses if you want to engage in a regulated industry.

The other government agencies you need to register your business with are as follows:

- Bureau of Internal Revenue (BIR) for corporate taxation

- Local Government Units (LGUs) of the location where you want to establish your business:

- Barangay Hall

- Mayor’s Office

- Business Permit and Licensing Office (BPLO) of the Municipal/City Hall

- If you want to employ individuals, you should register with the following agencies:

- Social Security System (SSS)

- Philippine Health Insurance Corporation (PhilHealth)

- Home Development Mutual Fund (Pag-IBIG Fund)

Things You Need To Do Before Starting the Incorporation Process

Prepare your Business Name

TIP: Prepare 3-5 alternative company names in case your first choice is unavailable (meaning, it already exists in SEC’s database or has been reserved with the SEC by another company).

Determine your Permanent Office Address

TIP: If you are pressed with time in having your business duly licensed with all appropriate government agencies or are looking for a cost-effective temporary location to set up your business before investing in a top-tier office address, you may avail the services of a virtual office space provider. You can transfer to a physical office later but you will need to amend your registration documents to update your company address. Amendment of documents will entail costs on document fees.

Steps of the Company Incorporation Process

Step 1: Reservation of Business Name with the Securities and Exchange Commission (SEC)

-If you will operate a sole proprietorship, you should reserve the name of your business with the Department of Trade and Industry (DTI); if you will operate a cooperative, you should reserve your business name with the Cooperative Development Authority (CDA)

Step 2: Submission of Documents to SEC

-You will be required to submit the following:

- Articles of Incorporation and By-Laws

- Treasurer’s Affidavit (signed by the incorporators for notarization)

-After complete submission of requirements, you will be issued by the SEC with a Certificate of Incorporation, a document that legitimizes the existence of your company and enables you to legally engage in business as well as become entitled to certain corporate rights in the Philippines

Step 3: Registration with Local Government Units (LGUs) of the location where you want to establish your business

-You will be required to secure the following:

- Barangay Clearance from the Barangay Hall

- Mayor’s Permit form the Mayor’s Office

- Business Permit from the Business Permit and Licensing Office (BPLO) of the Municipal/City Hall

Step 4: Registration with the Bureau of Internal Revenue (BIR) for corporate taxation

-Requisites for acquiring a BIR Certificate of Registration:

- 0605 Form (for payment of Annual Registration Fee)

- DST 2000 Form (for payment of subscription of shares for domestic corporations)

- DST 2000 Form (for payment of lease for all types of company formation)

- This requires a notarized copy of the lease contract of your office address

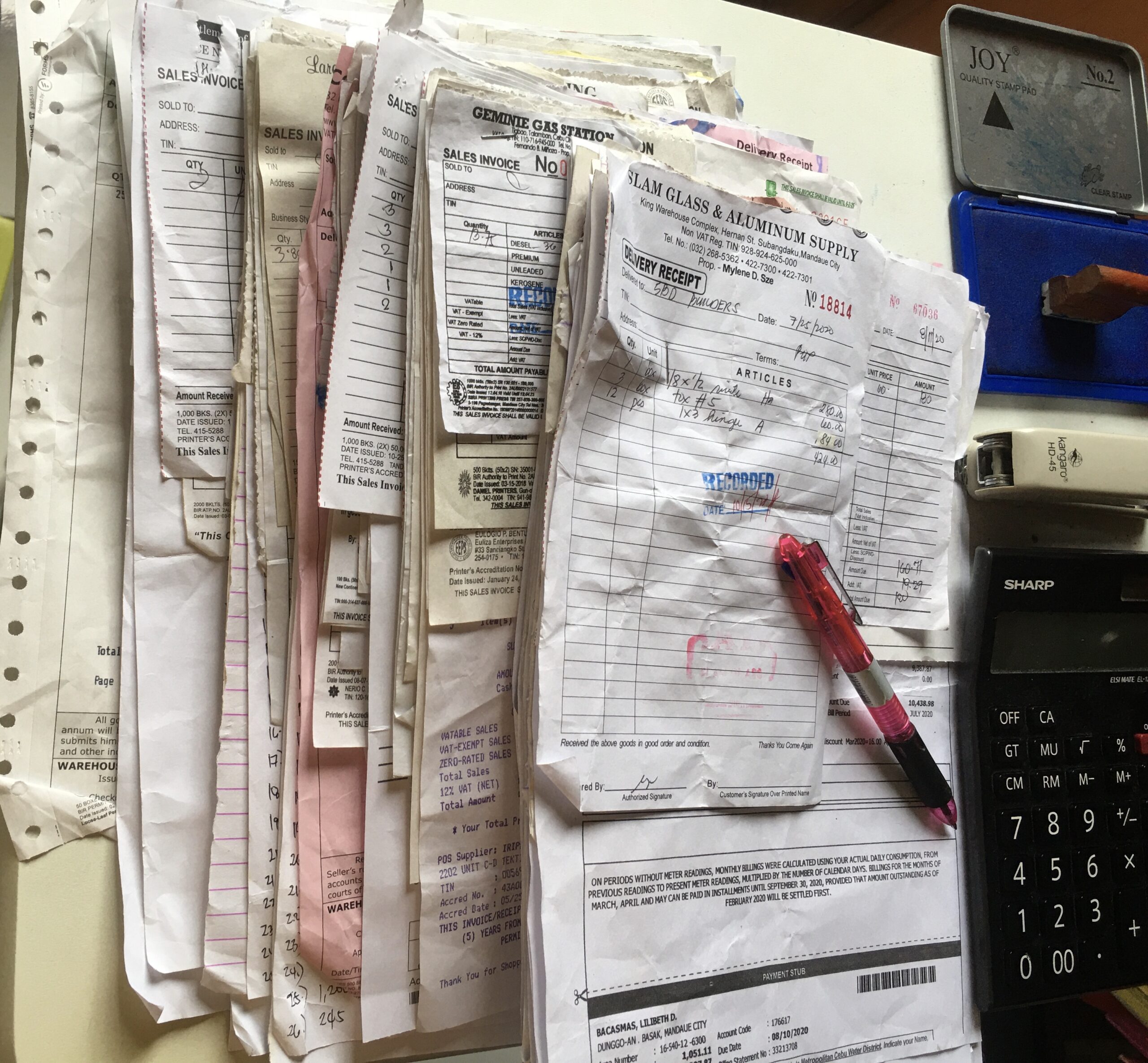

-Along with the BIR Certificate of Registration, you also need to secure the following:

- Certificate of Registration of Books of Account

- Cash Register Machine (CRM), Point of Sale (POS) Machine or Authority to Print Receipt/ Invoices (Manual Receipts)

Step 5: Registration with other Government Agencies (for employer registration if employing individuals)

- Social Security System (SSS) for social security benefits of employees

- Philippine Health Insurance Corporation (PhilHealth) for health insurance benefits of employees

- Home Development Mutual Fund (Pag-IBIG Fund) for housing benefits of employees